Yes. The federal government oversees the Health Insurance Marketplace (HealthCare.gov), and they determine who qualifies for financial assistance and how much, what paperwork is required to enroll or renew, and when people can enroll. The changes they make, including the expiration of the enhanced subsidies, apply to every insurance company in Florida.

No, the subsidies for plans sold on the Health Insurance Marketplace did not go away totally.

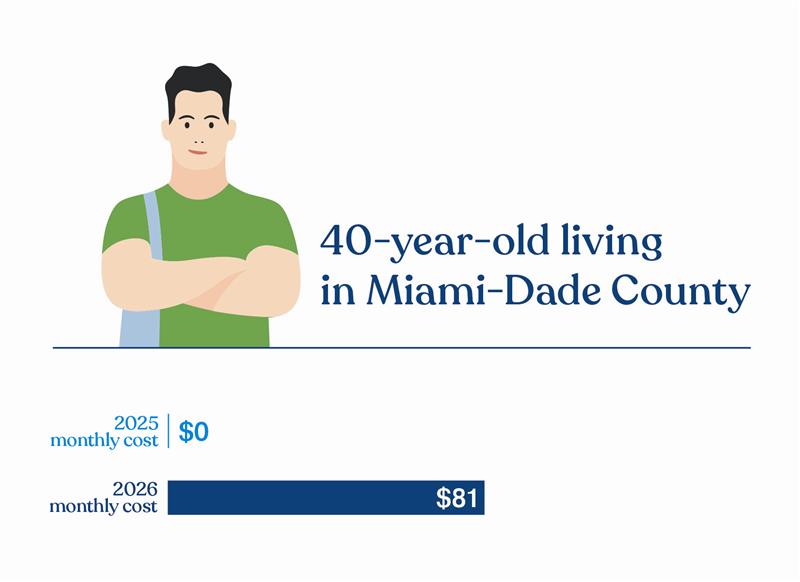

The 2021 American Rescue Plan Act increased the amount of financial help that some people received, and it allowed others over a certain annual income to get subsidies for the first time. These enhanced subsidy levels were planned to be in place for two years, but The Inflation Reduction Act later extended them for another two years. The enhanced subsidies, extra financial help the government put in place during the COVID-19 pandemic, expired at the end of 2025. In January 2026, subsidy levels went back to their pre-2021 American Rescue Plan Act levels.

With this change, millions of Americans lost some portion or all their financial help, making their monthly insurance costs more expensive.

When you’re with Florida Blue, you’re never alone. Our agents are licensed and specially trained to explain all the changes and find the best plan for your family’s needs. And there’s never an extra cost to work with them. We have a wide range of plans to fit many budgets, and our agents know how to help you get the most subsidy you can qualify for. Plus, all our plans include personalized care programs, exclusive discounts, and more at $0 extra cost. We’ll do everything we can to help you find a plan that fits your needs and your budget.

Marketplace rules and filing your taxes

Centers for Medicare & Medicaid Services (CMS), which is part of the federal government, is responsible for implementing and administering the Affordable Care Act. CMS determines who is eligible for financial assistance, how much they qualify for, what they must provide to prove they are eligible, and when they can enroll. The changes they make affect all insurance companies.

You must file your taxes for every year that you received a subsidy. When you enroll in or renew your insurance and apply for financial help, you estimate how much money you’ll make that year. When the year is over, you’ll need to confirm whether your estimate was correct.

You do this by filing your taxes and comparing your actual income to what you predicted. This is referred to as IRS form 8962. If you got more of a subsidy than you should have, you’ll have to pay back all of the extra financial assistance. On the other hand, if you got less of a subsidy than you should have, you could get some money back. The Marketplace may look at your taxes up to 2024 when you apply for a tax credit for plan year 2026.

When you enroll in or renew your insurance and apply for financial help, you estimate how much money you’ll make that year. When the year is over, you’ll need to confirm whether your estimate was correct. You do this by filing your taxes and comparing your actual income to what you predicted. If you got more of a subsidy than you should have, you’ll have to repay 100% of the extra amount. In the past, there was a limit on what you’d have to repay.

So, if your income fluctuates, you’ll need to update your Marketplace application during the year to avoid owing anything back. Don’t wait! From your online member account, choose My Plan & Insurance to see the link to update your application. Log in now to get started.

When, how, and why to enroll

The annual Open Enrollment Period is a time when individuals and families can enroll in a health insurance plan or renew their current plan for the upcoming year. In 2025, Open Enrollment ran from November 1, 2025, through January 15, 2026. Those who enrolled by December 15, 2025, have coverage starting on January 1, 2026. Those who enrolled between December 16, 2025, and January 15, 2026, have coverage starting February 1, 2026.

If it’s outside of the Open Enrollment Period, you must have a qualifying life event, which includes situations like losing your existing health insurance, getting married, having a baby, or moving to a new ZIP code to get coverage. If you miss Open Enrollment and do not qualify for a Special Enrollment Period (SEP), you may have to wait until the next Open Enrollment to get coverage. A Florida Blue agent can help determine if your life change qualifies you for an SEP.

We have knowledgeable agents standing by to answer your questions at no extra cost and there’s no obligation to buy a plan from them. Our agents are licensed and specially trained to explain all the changes and find the best plan for your family’s needs. Having this expert guidance at no extra cost is a perk of working with Florida Blue. It’s easy to find an agent near you, connect with an agent at a local Florida Blue Center in person or through a virtual chat, or call us at 1-844-396-2595.

No one plans to get sick or hurt, but most people will need medical care at some point. Having insurance means you won’t have to pay expensive medical bills on your own, whether you have a simple stomach bug or a serious accident or illness. For example, without health insurance, here are some common out-of-pocket costs:

- Average ER visit at a Florida hospital: $3,1002

- To treat a broken leg: $7,5003

- Average three-day hospital stay: $30,0003

- Cost of comprehensive cancer care: More than $100,0003

A recent report shows that 40% of adults in the United States have some type of health care debt.4 Medical debt shows up on your credit report, and medical bills contribute to nearly 70% of bankruptcies in the U.S.2 Having health insurance helps protect you and your loved ones from potentially huge health care expenses.

Health insurance is more than just a financial safety net — it can be a tool for getting healthier. Many insurance plans offer added personalized services, like help managing ongoing health conditions, for no extra cost. This can help you get the quality care you need for the least out of your pocket. Plus, with insurance, your checkups, vaccinations, yearly bloodwork, and annual cancer screenings are covered at no extra cost.

You may have heard of other types of health insurance plans, like short-term or accident and critical illness plans. These are very different types of policies. Marketplace plans are comprehensive health coverage that cover preventive care at a $0 copay plus government-required essential health benefits, and you can get this coverage even if you have pre-existing health conditions. These plans have no yearly dollar limit on what they could spend for your coverage.

Accident and critical illness plans are meant to be supplements to health insurance – they’re not substitutes for it. These types of plans typically pay a cash benefit if you are injured or become ill from a covered accident or illness. They don’t cover preventive care, routine sick care, or prescription drugs.

Short-term, limited-duration policies are designed to cover emergency and unexpected health issues over a short time period. They’re not required to cover preventive care and the essential health benefits listed above. They typically only cover conditions that come up after the plan’s effective date. So, if you have a pre-existing condition, you’ll likely have to pay the full cost of your care related to it.

Everyone’s situation and needs are unique. Florida Blue agents are experts at finding the right plan for you and your family’s needs and budget. They’ll work with you to get as much financial help as you can qualify for. There is no cost to get their guidance to be sure you understand what you’re buying and how it will work for you.