October 24, 2025

Large businesses in Florida are facing unprecedented challenges in managing the cost of health care for their employees. Rising medical expenses, driven by increasing specialty drug prices, and economic uncertainty, are putting pressure on companies to find ways to mitigate the financial impact. At Florida Blue, we understand the unique strain that large businesses face, and we’re innovating solutions that help better manage their costs of care.

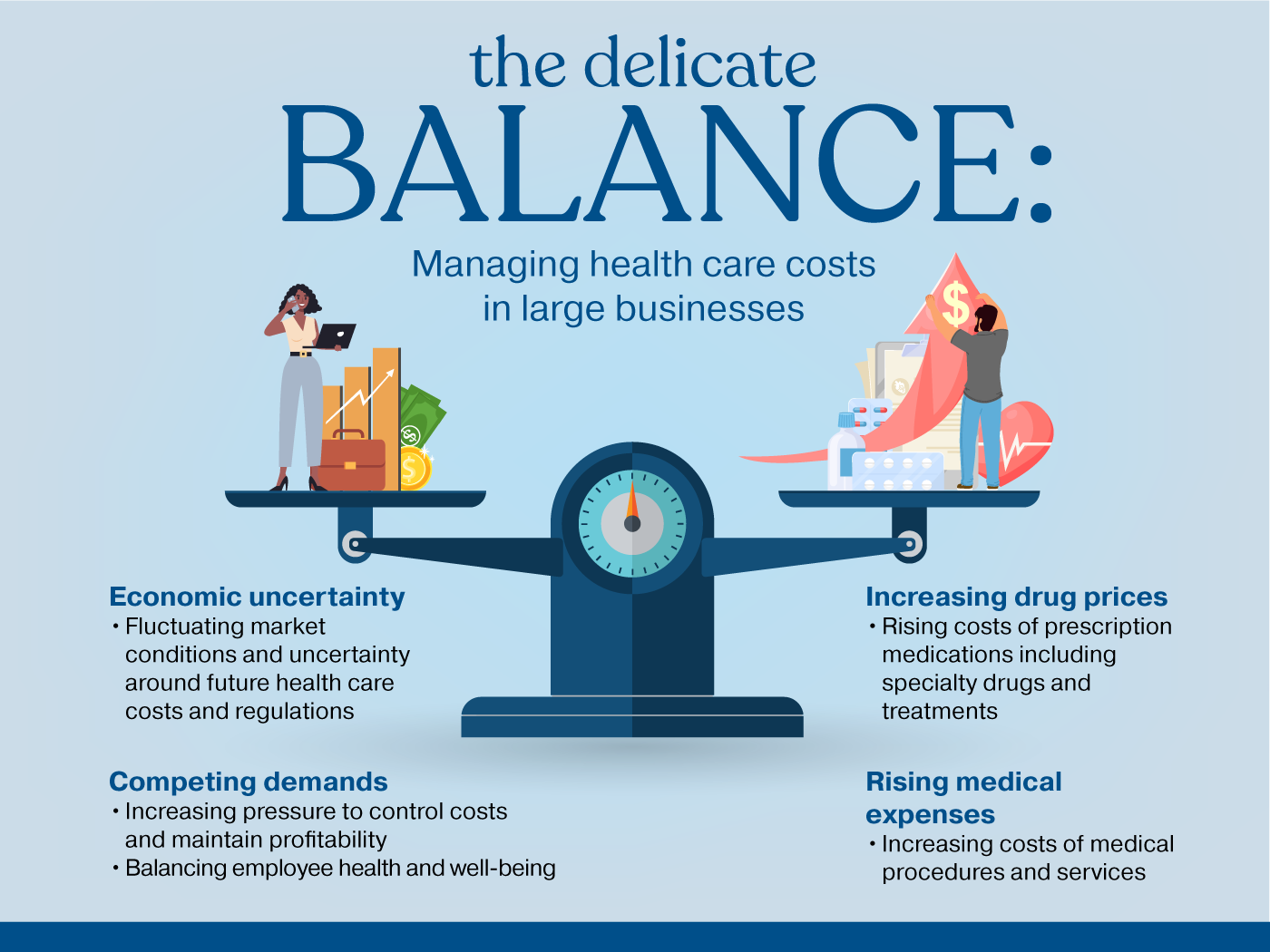

The challenges of managing health care costs

The current environment is causing many large businesses to struggle with managing the high-dollar health care expenditures of their employees. For example, specialty drugs, like those for oncology, immunology, and other rare diseases, have reached an all-time high, some costing tens of thousands of dollars per year, per person, with the expectation of them continuing to rise in the coming years.1 And life-changing treatments like gene therapy, can cost millions.2

Managing costs can be a daunting task that requires a delicate balance between providing comprehensive benefits to employees to attract and retain them and navigating the constraints of a tightening budget. Business leaders and HR professionals are often caught in the middle, struggling to reconcile the competing demands of employee health and financial sustainability.

Getting the right support matters

At Florida Blue, we know that one size doesn’t fit all when it comes to helping businesses manage their health care costs. We believe that working closely with the businesses we serve is key to navigating these complexities. We evaluate large businesses’ unique needs and develop tailored solutions that meet them. Our goal is to provide products and support that help our customers better manage their cost of care, while also improving the health and well-being of their employees.

Innovative solutions for managing health care costs

Florida Blue offers a suite of solutions designed to help large businesses address their specific needs:

- Our Stop Loss solution provides protection against catastrophic claims, helping to mitigate the financial risk associated with high-cost medical events. A recent report found $1M+ claims have increased 61% over the past four years.3 With Stop Loss, we're giving our customers the peace of mind that comes with knowing they're protected against unexpected medical expenses.

- DUO supplemental coverage helps provide additional financial protection for employees who may be facing high out-of-pocket medical expenses. Our DUO offerings include critical illness, accident, and hospital indemnity coverage, which can help alleviate the financial strain of unexpected medical events while supporting better health outcomes.

- With our comprehensive pharmacy approach, we work closely with our pharmacy benefits manager (PBM), Prime Therapeutics, to optimize medication management, improve adherence, and reduce waste — all while helping to control costs and improve the overall quality of care.

Our sales teams work with brokers and consultants who are all skilled to help large businesses determine what’s best for them and their employees. We take a customized approach to develop solutions that address specific pain points and help them reach their goals.

The bottom line

Our commitment to supporting large businesses with managing health care costs is more than just a priority — it's a reality. As a large business ourselves, we get it. And we're proud to be trusted by the large businesses we serve to navigate the challenges they face, especially when they need it most.

1 Med City News. Managing the Specialty Drug Cost Challenge: Is Your Pharmacy Benefits Strategy Ready for 2025?

2 Drug Discovery & Development. With prices topping $4 million, high stakes define cell and gene therapy landscape.